In this way no documents are required for online PAN card in 10 minutes.

Without a PAN card, no financial work is possible in India and you can process it from home in just 10 minutes.

- PAN card will be online

- Aadhar card will be available in 10 minutes

- PAN card is very important document in India

If you want to file income tax return or do any work related to bank, then you need PAN card, without which you will not get the benefit of any service. There is always trouble to make a PAN card in Teva. Tell him how to prepare it in just 10 minutes from

ગુજરાતીમાં ડીટેઇલ અહિંથી વાંચો

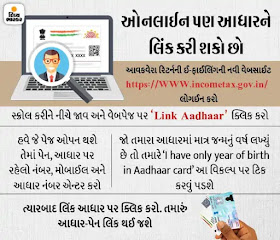

- First of all, you have to go to the e-filing portal of Incometax.

- Then go to the Quick link in the Instant Pan through the Aadhaar section.

- After which a new page will open and you have to click on Get New Pan.

- Then you have to enter the Aadhaar number for the new PAN card and then enter the captcha code and generate the OTP on the mobile number associated with Aadhaar.

- If OTP comes in mobile, then it has to be added

- Then email must be verified

- By adding e-KYC data with UIDAI after Aadhaar number, you will get instant PAN card

- After which you will have to download the PAN card in PDF format.

- No documents are required in this entire process.

- If you wish you can also order a laminated PAN card at your home address for to reprint of the pen card for Rs 50.

How To Check Adhar card and pan card Linked successfully or not

Linking your PAN card with Aadhaar has been made mandatory for certain services, such as filing your income tax returns. As per a recent directive from the Central Board of Direct Taxes (CBDT), the last date to link PAN with Aadhaar is

If you want to link your Aadhaar with your PAN card, you can visit 'How to Link Aadhaar Card and PAN Card' for more information

If you have already linked/seeded your PAN with your Aadhaar, you can check the status both online as well as offline.

The Income tax Department's e-Filing portal provides an easy and simple way to link your Aadhaar card with PAN card as well as to check the same.

Simply Follow The Below Steps To Check The Status Of Your Pan Card Seeding With Aadhaar.

Visit www.incometaxindiaefiling.gov.in/aadhaarstatus

Enter PAN and Aadhaar Number

Click on 'View Link Aadhaar Status'

The status of the linking is displayed in the next screen

IMPORTANT LINK:::

No comments:

Post a Comment